UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

| | |

| | |

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934 (Amendment No. __)

|

| | |

| | |

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

|

Check the appropriate box:

☐Preliminary Proxy Statement

☐Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒Definitive Proxy Statement

☐Definitive Additional Materials

☐Soliciting Material Pursuant to Rule 14a-12

|

Neoleukin Therapeutics, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (Check all boxes that apply):

☒ No fee required

☐ Fee paid previously with preliminary materials

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

|

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material under §240.14a-12

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ No fee required.

☐ Fee paid previously with preliminary materials.

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

| | | | | | | | | | | |

| NEOLEUKIN THERAPEUTICS, INC.

188 East Blaine Street, Suite 450

Seattle, WA 98102 | | |

Notice of Annual Meeting

of Stockholders

TO BE HELD ON JUNE 8, 2023April 26, 2024

Dear Stockholder:

You are cordially invited to attend the 2024 Annual Meeting of Stockholders of Neoleukin Therapeutics,Neurogene Inc., a Delaware corporation (the “Company”). The meeting is expected to be held virtually at 11:00 a.m., Eastern Time, on June 8,14, 2024. You will be able to virtually attend the meeting, submit your questions and comments, and vote your shares at the meeting by visiting www.virtualshareholdermeeting.com/NGNE2024. We believe that a virtual meeting facilitates stockholder participation, improves communication and saves on the expenses traditionally incurred for in-person annual meetings.

We have elected to deliver our proxy materials to our shareholders over the Internet and will mail to our shareholders a Notice of Internet Availability of Proxy Materials containing instructions on how to access our Proxy Statement and our 2023 annual report to shareholders. The Notice of Internet Availability of Proxy Materials also provides instructions on how to vote by telephone or Internet and includes instructions on how to receive a paper copy of the proxy materials by mail. You may also find copies of these items online at 1:30 p.m. Pacific Time. ir.neurogene.com/financial-information/sec-filings.

The matters to be voted on are described in the accompanying Notice of 2024 Annual Meeting of Stockholders and Proxy Statement. Our Board of Directors recommends that you vote in accordance with each of its recommendations regarding the proposals listed in the Notice of 2024 Annual Meeting of Stockholders and described in the accompanying Proxy Statement.

Your vote is important. Whether or not you expect to attend the Annual Meeting, we encourage you to read the Proxy Statement and vote by Internet or, if you requested paper copies of the proxy materials, by telephone or by submitting your signed and dated proxy card to ensure your representation at the Annual Meeting. For specific instructions on how to vote your shares, please refer to the section entitled “Questions and Answers about the Proxy Materials and Voting” beginning on page 1 of the proxy statement and the instructions on the Notice of Internet Availability of Proxy Materials. Providing voting instructions or returning your proxy card in advance of the meeting will not prevent you from voting on the website during the meeting but will ensure that your vote is counted if you are unable to attend. Sincerely,

Rachel McMinn, Ph.D.

Executive Chair,

Founder and Chief Executive Officer

535 W. 24th Street, 5th Floor, New York, NY 10011

NOTICE OF 2024 ANNUAL MEETING OF STOCKHOLDERS

To Be Held Friday, June 14, 2024, 11:00 a.m. (Eastern Time)

Virtual Meeting Only — No Physical Meeting Location

To Our Stockholders:

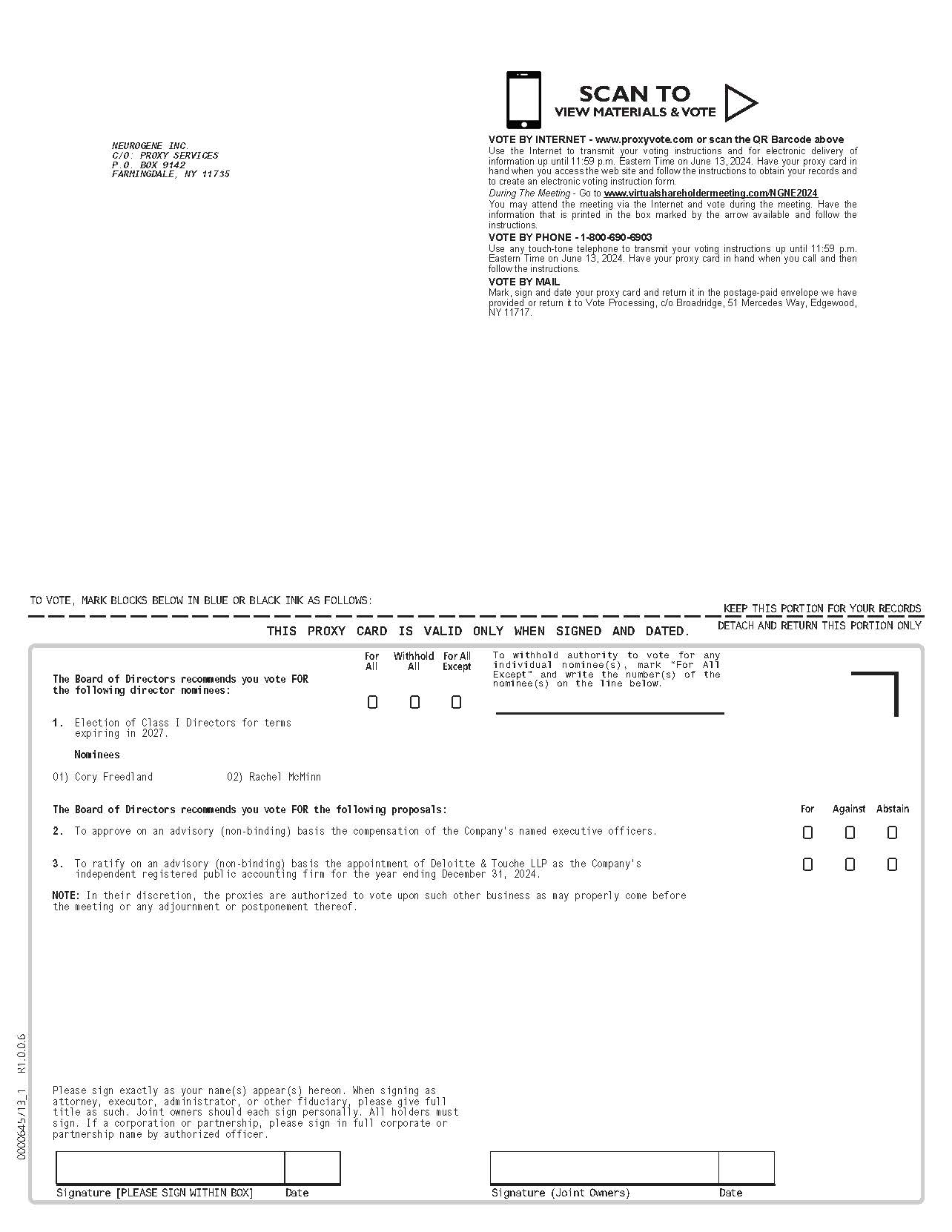

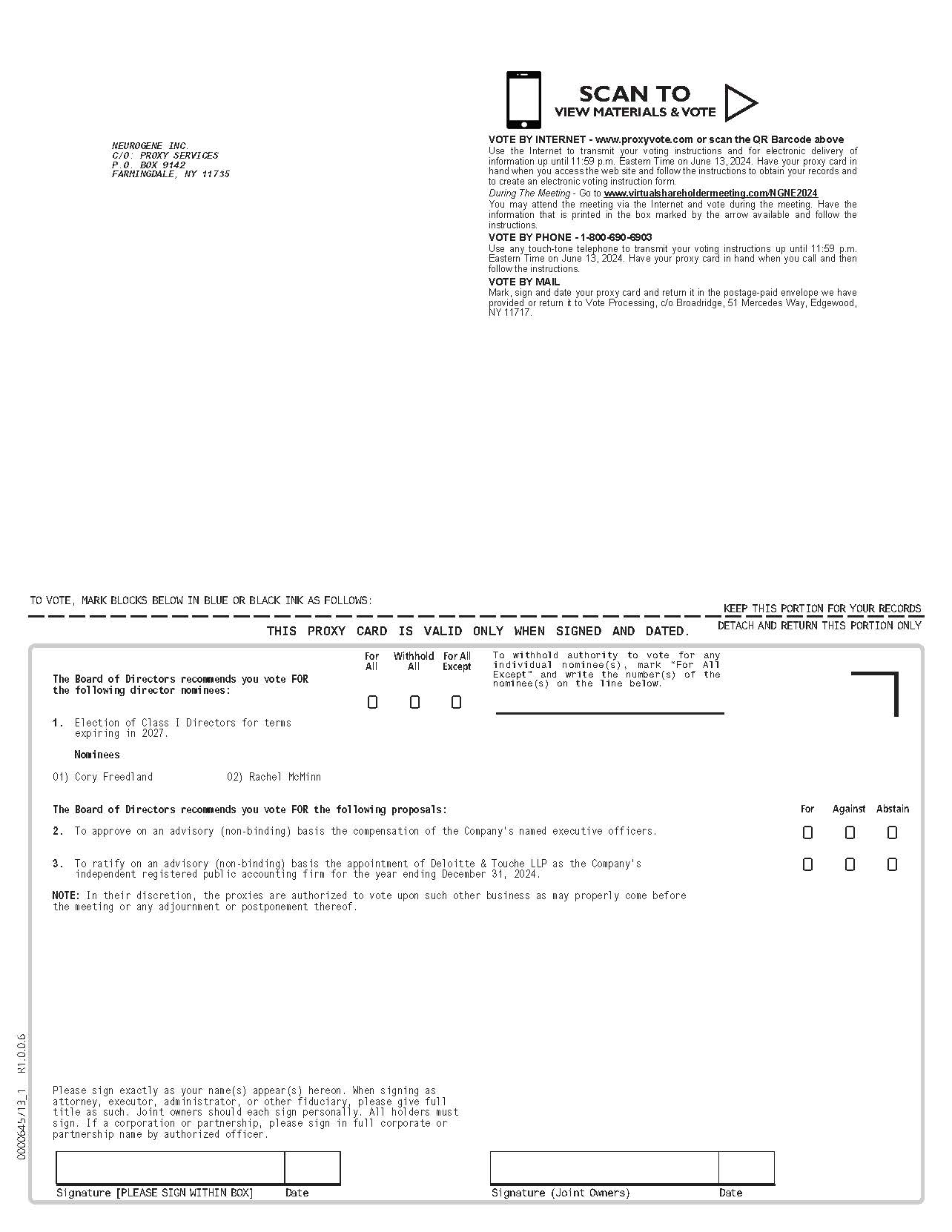

NOTICE IS HEREBY GIVEN that the 2024 Annual Meeting of Stockholders ("Annual Meeting") of Neurogene Inc., a Delaware corporation (the “Company”), will be held in a virtual-only format, via live webcast, on Friday, June 14, 2024 at 11:00 a.m. (Eastern Time). The purpose of this meeting is to consider and vote upon the following matters:

1.To elect Cory Freedland and Rachel McMinn as Class I directors to our Board of Directors to serve until the 2027 annual meeting of stockholders and until their respective successors are elected and qualified;

2.To approve on an advisory (non-binding) basis of the compensation of the Company’s named executive officers;

3.To ratify on an advisory (non-binding) basis of the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2024; and

4.To transact any other matters that may properly come before the Annual Meeting or any adjournments or postponements thereof.

The foregoing items of business are more fully described in the proxy statement accompanying this Notice of 2024 Annual Meeting of Stockholders (the “Proxy Statement”). We also will transact any other business that may properly come before the Annual Meeting, but we are not aware of any such additional matters.

Only stockholders of record at the close of business on April 18, 2024, are entitled to notice of, and to vote at, the Annual Meeting or any adjournment or postponement of the meeting. The accompanying Proxy Statement and the proxy card were either made available to you online or mailed to you beginning on or about April 26, 2024.

To facilitate stockholder participation and save on expenses associated with conducting an in-person annual meeting, the Annual Meeting will be held in a virtual meeting format only at www.virtualshareholdermeeting.com/NLTX2023.only. You will not be able to virtually attend the meeting, submit your questions and comments, and vote your shares at the meeting by visiting www.virtualshareholdermeeting.com/NGNE2024.

In the event of a technical malfunction or other situation that the meeting chair determines may affect the ability of the Annual Meeting in person. Theto satisfy the requirements for a meeting willof stockholders to be held by means of remote communication under the Delaware General Corporation Law, or that otherwise makes it advisable to adjourn the Annual Meeting, the meeting chair or secretary will convene the meeting at 12:00 p.m. Eastern Time on the date specified above and at the Company’s address specified above solely for the following purposes:purpose of adjourning the meeting to reconvene at a date, time and physical or virtual location announced by the meeting chair or secretary. Under either of the foregoing circumstances, we will post information regarding the announcement on the Investor page of the Company’s website at https://ir.neurogene.com.

Whether or not you expect to attend the annual meeting, we encourage you to read the Proxy Statement and vote as soon as possible, so that your shares may be represented at the meeting. For specific instructions on how to vote your shares, please refer to the section entitled “Questions and Answers About the Proxy Materials and Voting” beginning on page 1 of the accompanying Proxy Statement and the instructions on the Notice of Internet Availability of Proxy Materials. Christine Mikail

President, Chief Financial Officer and Corporate Secretary

April 26, 2024

TABLE OF CONTENTS

| | | | | | | | |

| | Page |

1 | | To elect M. Cantey Boyd, Rohan Palekar, and Todd S. Simpson as Class III directors of the Company to hold office until the 2026 Annual Meeting of Stockholders. |

2 | | To approve, at the discretion of the Company’s Board |

| | |

3 | | To approve an amendment to the Company’s Certificate of Incorporation to permit the exculpation of officers from personal liability for certain breaches of the duty of care (the “Exculpation Amendment”). |

4 | | To ratify the appointment of Deloitte & Touche LLP as the independent registered public accounting firm of the Company for its fiscal year ending December 31, 2023. |

5 | | To approve, by a non-binding advisory vote, the compensation paid by the Company to its named executive officers. |

6 | | To conduct any other business properly brought before the meeting. |

| | |

| | |

| | |

| | |

LEGAL MATTERS

Neoleukin-Neurogene Merger. On December 18, 2023 (the “Merger Closing”), the Company consummated a business combination (the “Merger”) pursuant to an Agreement and Plan of Merger, dated as of July 17, 2023 (the “Merger Agreement”), by and among the Company (which prior to the Merger Closing was known as Neoleukin Therapeutics, Inc., or “Neoleukin”), Project North Merger Sub, Inc., a Delaware corporation and wholly owned subsidiary of Neoleukin (“Merger Sub”), and Neurogene Inc., a Nevada corporation (“Private Neurogene” and formerly a Delaware corporation). Pursuant to the Merger Agreement, Merger Sub merged with and into Private Neurogene, with Private Neurogene surviving the Merger as a wholly owned subsidiary of the Company. In connection with the completion of the Merger, the Company changed its name from “Neoleukin Therapeutics, Inc.” to “Neurogene Inc.” and its Nasdaq ticker symbol from “NLTX” to “NGNE.”

Information about solicitation and voting. The accompanying proxy is solicited on behalf of the Board of Directors (the “Board”) of Neurogene Inc. (“we”, “us”, “our”, “Neurogene” or the “Company”) for use at the Company’s 2024 Annual Meeting of Stockholders (the “Annual Meeting” or “meeting”) to be held on June 14, 2024 at 11:00 a.m. Eastern Time as a virtual-only meeting which can be accessed at www.virtualshareholdermeeting.com/NGNE2024.

Internet Availability of Proxy Materials. Under rules adopted by the U.S. Securities and Exchange Commission (“SEC”), we are furnishing proxy materials to our stockholders primarily via the internet, instead of mailing printed copies of those materials to each stockholder. On or about April 26, 2024, we expect to send our stockholders a Notice of Internet Availability of Proxy Materials (“Notice”) containing instructions on how to access our proxy materials, including our Proxy Statement and our 2023 annual report to stockholders. The Notice also provides instructions on how to vote by Internet and includes instructions on how to receive a paper copy of the proxy materials by mail. If you prefer to receive printed proxy materials, please follow the instructions included in the Notice.

Important Notice Regarding the Availability of Proxy Materials for the 2024 Annual Meeting of Stockholders to Be Held on June 14, 2024. The Proxy Statement and Annual Report for the year ended December 31, 2023 are available at www.proxyvote.com.

Forward-Looking Statements. The Proxy Statement may contain “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, which statements are subject to substantial risks and uncertainties and are based on estimates and assumptions. All statements other than statements of historical fact included in the Proxy Statement, including statements about the Company’s Board of Directors, corporate governance practices and executive compensation program and equity compensation utilization, are forward-looking statements. In some cases, you can identify forward-looking statements by terms such as “may,” “might,” “will,” “objective,” “intend,” “should,” “could,” “can,” “would,” “expect,” “believe,” “design,” “estimate,” “predict,” “potential,” “plan” or the negative of these terms, and similar expressions intended to identify forward-looking statements. These items of business are more fullystatements involve known and unknown risks, uncertainties and other factors that could cause our actual results to differ materially from the forward-looking statements expressed or implied in the Proxy Statement. Such risks, uncertainties and other factors include those risks described in “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the Company’s most recent Annual Report on Form 10-K filed with the SEC and other subsequent documents we file with the SEC. The Company expressly disclaims any obligation to update or alter any statements whether as a result of new information, future events or otherwise, except as required by law.

Website References. Website references throughout this document are inactive textual references and provided for convenience only, and the content on the referenced websites is not incorporated herein by reference and does not constitute a part of the Proxy Statement.

Use of Trademarks. Neurogene is the trademark of Neurogene Inc. Other names and brands may be claimed as the property of others.

535 W 24th Street, 5th Floor, New York, NY 10011

PROXY STATEMENT

FOR THE 2024 ANNUAL MEETING OF STOCKHOLDERS

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND VOTING

What Is the Purpose of These Proxy Materials?

We are making these proxy materials available to you in connection with the solicitation of proxies by the Board for use at the 2024 Annual Meeting of Stockholders (the “Annual Meeting”) to be held virtually on June 14, 2024 at 11:00 a.m. Eastern Time, or at any other time following adjournment or postponement thereof. You are invited to participate in the Annual Meeting and to vote on the proposals described in this proxy statement (the “Proxy Statement”). The proxy materials are first being made available to our stockholders on or about April 26, 2024.

Why Did I Receive a Notice of Internet Availability?

Pursuant to SEC rules, we are furnishing the proxy statement accompanying this Notice.

materials to our stockholders primarily via the Internet instead of mailing printed copies. This process allows us to expedite our stockholders’ receipt of proxy materials, lower the costs of printing and mailing the proxy materials and reduce the environmental impact of our Annual Meeting. If you received a Notice, you will not receive a printed copy of the proxy materials unless you request one. The record dateNotice provides instructions on how to access the proxy materials for the Annual Meeting via the Internet, how to request a printed set of proxy materials and how to vote your shares.

Why Are We Holding a Virtual Annual Meeting?

We have adopted a virtual meeting format for the Annual Meeting to provide a consistent experience to all stockholders regardless of geographic location. We believe this expands stockholder access, improves communications and lowers our costs while reducing the environmental impact of the meeting. In structuring our virtual Annual Meeting, our goal is April 20, 2023. to enhance rather than constrain stockholder participation in the meeting, and we have designed the meeting to provide stockholders with the same rights and opportunities to participate as they would have at an in-person meeting.

Who Can Vote?

Only stockholders of record at the close of business on April 18, 2024 (the “Record Date”) are entitled to notice of the Annual Meeting and to vote on the proposals described in this Proxy Statement. At the close of business on the Record Date, 12,865,684 shares of our common stock were issued and outstanding.

What Is the Difference between Holding Shares as a Registered Stockholder and as a Beneficial Owner?

Registered Stockholder: Shares Registered in Your Name

If your shares of common stock are registered directly in your name with our transfer agent, Equiniti Trust Company, LLC (formerly known as American Stock Transfer & Trust Company LLC), you are considered to be, with respect to those shares of common stock, the registered stockholder, and these proxy materials are being sent directly to you by us.

Beneficial Owner: Shares Registered in the Name of a Broker, Fiduciary or Custodian

If your shares of common stock are held by a broker, fiduciary or custodian, you are considered the beneficial owner of shares of common stock held in “street name,” and these proxy materials are being forwarded to you from that date maybroker, fiduciary or custodian.

Under certain circumstances banks, brokers and other nominees are prohibited from exercising discretionary authority for beneficial owners who have not provided voting instructions to the bank, broker or other nominee, which is referred to as

a “broker non-vote”. In these cases, those shares will be counted for the purpose of determining whether a quorum is present, but will not be voted on any matters deemed non-routine. See also “What Happens If I Do Not Vote?” and “What Happens If I Sign and Return a Proxy Card or Otherwise Vote but Do Not Indicate Specific Choices?” below.

How Can I Participate in the Virtual Annual Meeting?

Stockholders of record as of the close of business on the Record Date are entitled to participate in and vote at the Annual Meeting. To participate in the Annual Meeting, including to vote and ask questions, stockholders of record should go to the meeting website at www.virtualshareholdermeeting.com/NGNE2024, enter the 16-digit control number found on your proxy card or Notice, and follow the instructions on the website. If your shares are held in street name and your voting instruction form or Notice indicates that you may vote those shares through www.proxyvote.com, then you may access, participate in and vote at the Annual Meeting with the 16-digit access code indicated on that voting instruction form or Notice. Otherwise, stockholders who hold their shares in street name should contact their bank, broker or other nominee (preferably at least five days before the Annual Meeting) and obtain a “legal proxy” in order to be able to attend, participate in or vote at the Annual Meeting.

We will endeavor to answer as many stockholder-submitted questions as time permits that comply with the Annual Meeting rules of conduct. We reserve the right to edit profanity or other inappropriate language and to exclude questions regarding topics that are not pertinent to meeting matters or Company business. If we receive substantially similar questions, we may group such questions together and provide a single response to avoid repetition.

The meeting webcast will begin promptly at 11:00 a.m. Eastern Time. Online check-in will begin approximately 15 minutes before then, and we encourage you to allow ample time for check-in procedures. If you experience technical difficulties during the check-in process or during the meeting, please call the number listed on the meeting website for technical support. Additional information regarding the rules and procedures for participating in the Annual Meeting will be set forth in our meeting rules of conduct, which stockholders can view during the meeting at the meeting website.

What Am I Voting on?

The proposals to be voted on at the Annual Meeting are as follows:

(1) Election of two Class I director nominees to serve until the 2027 Annual Meeting of Stockholders (“Proposal 1”);

(2) Approval, on a non-binding, advisory basis, of the compensation of the Company’s named executive officers (“Proposal 2”); and

(3) Ratification of the appointment of Deloitte & Touche LLP as the Company’s independent auditor for 2024 (“Proposal 3”).

How Does the Board Recommend That I Vote?

The Board recommends that you vote your shares “FOR” each director nominee in Proposal 1 and “FOR” Proposals 2 and 3.

What If Another Matter Is Properly Brought before the Annual Meeting?

As of the date of filing this Proxy Statement, the Board knows of no other matters that will be presented for consideration at the Annual Meeting. If any other matters are properly brought before the Annual Meeting, it is the intention of the persons named as proxies in the proxy card to vote on such matters in accordance with their best judgment.

How Many Votes Do I Have?

Each share of common stock you owned on the Record Date is entitled to one vote for each director candidate. You may NOT cumulate votes relating to the election of directors. For the other matters presented at this meeting, you are entitled to one vote for each share of common stock you owned on the Record Date.

What Does It Mean If I Receive More Than One Set of Proxy Materials?

If you receive more than one set of proxy materials, your shares may be registered in more than one name or held in different accounts. Please cast your vote with respect to each set of proxy materials that you receive to ensure that all of your shares are voted.

Please note that if you have more than one account through which you hold shares, you will receive more than one control number. The control number is used to vote your shares, and is also used to log on to the meeting website to virtually

attend the meeting, which will allow you to vote the shares held in the account associated with that control number at the meeting. However, you will not be able to vote shares held in other accounts not associated with the control number you are using to log in to the virtual shareholder meeting. Therefore, it is important that you vote in advance for all of your accounts prior to the Annual Meeting so that all of your shares may be counted.

How Do I Vote?

Even if you plan to attend the Annual Meeting, we recommend that you also submit your vote as early as possible in advance so that your vote will be counted if you later decide not to, or are unable to, virtually attend the Annual Meeting.

Registered Stockholder: Shares Registered in Your Name

If you are the registered stockholder, you may vote your shares online during the virtual Annual Meeting (see “How Can I Participate in the Virtual Annual Meeting?” above) or by proxy in advance of the Annual Meeting by Internet (at www.proxyvote.com) or, if you requested paper copies of the proxy materials, by completing and mailing a proxy card or by telephone (at 800-690-6903).

Beneficial Owner: Shares Registered in the Name of a Broker, Fiduciary or Custodian

If you are the beneficial owner, you may vote your shares online during the virtual Annual Meeting (see “How Can I Participate in the Virtual Annual Meeting?” above) or you may direct your broker, fiduciary or custodian how to vote in advance of the Annual Meeting by following the instructions they provide.

What Happens If I Do Not Vote?

Registered Stockholder: Shares Registered in Your Name

If you are the registered stockholder and do not vote in one of the ways described above, your shares will not be voted at the Annual Meeting and will not be counted toward the quorum requirement.

Beneficial Owner: Shares Registered in the Name of a Broker, Fiduciary or Custodian

If you are the beneficial owner and do not direct your broker, fiduciary or custodian how to vote your shares, your broker, fiduciary or custodian will only be able to vote your shares with respect to proposals considered to be “routine.” Your broker, fiduciary or custodian is not entitled to vote your shares with respect to “non-routine” proposals, which we refer to as a “broker non-vote.” Whether a proposal is considered routine or non-routine is subject to stock exchange rules and final determination by the stock exchange. Even with respect to routine matters, some brokers are choosing not to exercise discretionary voting authority. As a result, we urge you to direct your broker, fiduciary or custodian how to vote your shares on all proposals to ensure that your vote is counted.

What Happens If I Sign and Return a Proxy Card or Otherwise Vote but Do Not Indicate Specific Choices?

Registered Stockholder: Shares Registered in Your Name

The shares represented by each signed and returned proxy will be voted at the Annual Meeting by the persons named as proxies in the proxy card in accordance with the instructions indicated on the proxy card. However, if you are the registered stockholder and sign and return your proxy card without giving specific instructions, the persons named as proxies in the proxy card will vote your shares in accordance with the recommendations of the Board. Your shares will be counted toward the quorum requirement.

Beneficial Owner: Shares Registered in the Name of a Broker, Fiduciary or Custodian

If you are the beneficial owner and do not direct your broker, fiduciary or custodian how to vote your shares, your broker, fiduciary or custodian will only be able to vote your shares with respect to proposals considered to be “routine.” Your broker, fiduciary or custodian is not entitled to vote your shares with respect to “non-routine” proposals, resulting in a broker non-vote with respect to such proposals.

Can I Change My Vote after I Submit My Proxy?

Registered Stockholder: Shares Registered in Your Name

If you are the registered stockholder, you may revoke your proxy at any time before the final vote at the Annual Meeting in any one of the following ways:

(1) You may complete and submit a new proxy card, but it must bear a later date than the original proxy card;

(2) You may submit new proxy instructions via telephone or the Internet;

(3) You may send a timely written notice that you are revoking your proxy to our Corporate Secretary at the address set forth on the first page of this Proxy Statement; or

(4) You may vote by attending the Annual Meeting virtually. However, your virtual attendance at the Annual Meeting will not, by itself, revoke your proxy.

Your last submitted vote is the one that will be counted.

Beneficial Owner: Shares Registered in the Name of a Broker, Fiduciary or Custodian

If you are the beneficial owner, you must follow the instructions you receive from your broker, fiduciary or custodian with respect to changing your vote.

What Is the Quorum Requirement?

The holders of a majority of the shares of common stock outstanding and entitled to vote at the Annual Meeting, either virtually or represented by proxy, must be present at the Annual Meeting to constitute a quorum. A quorum is required to transact business at the Annual Meeting.

Your shares will be counted toward the quorum only if you submit a valid proxy (or a valid proxy is submitted on your behalf by your broker, fiduciary or custodian) or if you attend the Annual Meeting virtually and vote. Abstentions and broker non-votes, if any, will be counted toward the quorum requirement. If there is no quorum, the chair of the Annual Meeting or the holders of a majority of shares of common stock present at the Annual Meeting, either virtually or represented by proxy, may adjourn the Annual Meeting to another time or date.

How Many Votes Are Required to Approve Each Proposal and How Are Votes Counted?

Votes will be counted by Broadridge Financial Solutions, the Inspector of Elections appointed for the Annual Meeting.

Proposal 1: Election of Directors

A nominee will be elected as a director at the Annual Meeting if the nominee receives a plurality of the votes cast “FOR” his or her election. “Plurality” means that the individuals who receive the highest number of votes cast “FOR” are elected as directors. Broker non-votes, if any, and votes that are withheld will not be counted as votes cast on the matter and will have no effect on the outcome of the election. Stockholders do not have cumulative voting rights for the election of directors.

Proposal 2: Non-Binding Advisory Vote on Executive Compensation

The affirmative vote of the holders of at least a majority of shares of common stock present or represented at the Annual Meeting and entitled to vote on the matter is required to approve this proposal. Abstentions will have the same effect as a vote “AGAINST” the matter. Broker non-votes, if any, will have no effect on the outcome of the matter.

Proposal 3: Ratification of Independent Auditor Appointment

The affirmative vote of the holders of at least a majority of shares of common stock present or represented at the Annual Meeting and entitled to vote on the matter is required to approve this proposal. Abstentions will have the same effect as a vote “AGAINST” the matter. Broker non-votes, if any, will have no effect on the outcome of the matter.

Who Is Paying for This Proxy Solicitation?

We will pay the costs associated with the solicitation of proxies, including the preparation, assembly, printing and mailing of the proxy materials. We may also reimburse brokers, fiduciaries or custodians for the cost of forwarding proxy materials to beneficial owners of shares of common stock held in “street name.”

Our employees, officers and directors may solicit proxies in person or via telephone or the Internet. We will not pay additional compensation for any of these services.

When are Stockholder Proposals and Director Nominations Due for Next Year’s Annual Meeting?

Stockholders who wish to submit proposals for inclusion in next year’s proxy materials must submit such proposals in writing by December 27, 2024, to our Corporate Secretary at 535 W. 24th Street, 5th Floor, New York, NY 10011, and must comply with all applicable requirements of Rule 14a-8 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”); provided, however, that if our 2025 Annual Meeting of Stockholders is held before May 15, 2025 or after July 14, 2025, then the deadline is a reasonable amount of time prior to the date we begin to print and mail our proxy statement for the 2025 Annual Meeting of Stockholders. A submission of a stockholder proposal does not guarantee that it will be included in the proxy materials.

If you wish to submit a proposal (including a director nomination) at the 2025 Annual Meeting of Stockholders (other than pursuant to Rule 14a-8 of the Exchange Act), the proposal must be received by our Corporate Secretary not later than the close of business on March 16, 2025 nor earlier than the close of business on February 14, 2025; provided, however, that if our 2025 Annual Meeting of Stockholders is held before May 15, 2025 or after August 13, 2025, then the proposal must be received no earlier than February 14, 2025 and not later than the close of business on the later of the 90th day prior to such meeting or the 10th day following the date on which public announcement of the date of such meeting is first made. Any such director nomination or stockholder proposal must be a proper matter for stockholder action and must comply with the terms and conditions set forth in our Bylaws (which includes the timing and information required under Rule 14a-19 of the Exchange Act).If a stockholder fails to meet these deadlines or fails to satisfy the requirements of Rule 14a-4 of the Exchange Act, we may exercise discretionary voting authority under proxies we solicit to vote on any adjournment thereof.such proposal as we determine appropriate. We reserve the right to reject, rule out of order or take other appropriate action with respect to any nomination or proposal that does not comply with these and other applicable requirements.

| | | | | |

| By Order of the Board of Directors

Todd Simpson, Chairman of the Board

Seattle, Washington

April 27, 2023

|

How Can I Find out the Voting Results?We expect to announce preliminary voting results at the Annual Meeting. Final voting results will be published in a Current Report on Form 8-K to be filed with the SEC within four business days after the Annual Meeting.

Who Can Help Answer Any Questions I May Have?

If you have any questions or require any assistance with voting your shares, or if you need additional copies of the proxy materials, please contact:

Neurogene Inc.

Attn: Corporate Secretary 535 W. 24th Street, 5th Floor

New York, NY 10011

TablePROPOSAL 1: ELECTION OF DIRECTORS

In accordance with our Certificate of ContentsIncorporation and Bylaws, the Board has fixed the number of directors constituting the Board at six. At the Annual Meeting, the stockholders will vote to elect the two Class I director nominees named in this Proxy Statement to serve until the 2027 Annual Meeting of Stockholders and until their successors are duly elected and qualified or until their earlier resignation or removal. Our Board has nominated Dr. Cory Freedland and Dr. Rachel McMinn for election to our Board. Each of Drs. Freedland and McMinn was initially appointed to the Board in December 2023 in accordance with the Merger Agreement.

Our director nominees have indicated that they are willing and able to serve as directors. However, if either of them becomes unable or, for good cause, unwilling to serve, proxies may be voted for the election of such other person as shall be designated by our Board, or the Board may decrease the size of the Board.

Information Regarding Director Nominees and Continuing Directors

Our Board is divided into three classes, with members of each class holding office for staggered three-year terms. There are currently two Class I directors, who are up for election at this meeting for a term expiring at the 2027 Annual Meeting of Stockholders; two Class II directors, whose terms expire at the 2025 Annual Meeting of Stockholders; and two Class III directors, whose terms expire at the 2026 Annual Meeting of Stockholders.

Biographical and other information regarding our director nominees and directors continuing in office, including the primary skills and experiences considered by our Nominating and Corporate Governance Committee (the “Nominating Committee”) in determining to recommend them as nominees, is set forth below.

| | | | | | | | | | | |

| Name | Class | Age (as of April 26) | | | Position |

QuestionsRachel McMinn, Ph.D. | I | 51 | Executive Chair and Answers | Chief Executive Officer |

Proposal Number 1: Election of DirectorsRobert Baffi, Ph.D.(2)(3) | III | 69 | Director |

Information Regarding the Board of Directors and Corporate GovernanceCory Freedland, Ph.D.(1) | I | 48 | Director |

Report of the Audit Committee of the Board of DirectorsSarah B. Noonberg, M.D., Ph.D.(2) | II | 56 | Director |

Proposal Number 2: Approval of Amendment to Amended and Restated Certificate of Incorporation for Reverse Stock Split AmendmentRohan Palekar(1)(2) | III | 58 | Director |

Proposal Number 3: Approval of Amendment to Amended and Restated Certificate of Incorporation for Exculpation AmendmentRobert Keith Woods (“Keith Woods”)(1)(3) | |

Proposal Number 4: Ratification of Appointment of Independent Registered Public Accounting FirmII | |

Equity Compensation Plan Information56 | |

Proposal Number 5: Non-Binding Advisory Vote on Named Executive Officer Compensation | |

Security Ownership of Certain Beneficial Owners and Management | |

Executive Officers | |

Executive Compensation | |

Pay Versus Performance | |

Director Compensation | |

Transactions with Related Persons | |

Householding of Proxy Materials | |

Where You Can Find More Information | |

Other Matters | |

Appendix A - Form of Amendment to Certificate of Incorporation (Reverse Stock Split) | |

Appendix B - Form of Amendment to Certificate of Incorporation (Exculpation) | |

(1) Member of the Audit Committee

(2) Member of the Compensation Committee

(3) Member of the Nominating Committee

Class I Director Nominees

Cory Freedland, Ph.D.Dr. Freedland has served as a member of our Board since December 2023 and served as the board of directors of Private Neurogene from February 2019 to December 2023.Dr. Freedland is a Partner at Samsara BioCapital (“Samsara”), an investment company focused on the life sciences industry, which he joined in October 2017. Dr. Freedland has over 20 years of experience, leading multiple successful life science investments in his role. Prior to Samsara, Dr. Freedland was a Principal at Sofinnova Ventures, a biopharmaceutical venture capital firm, where he focused on biopharmaceutical investments. He played a central role in Sofinnova’s investments in Civitas Therapeutics, Inc. (acquired by Acorda Therapeutics, Inc.), Principia Biopharma, Spark Therapeutics, Inc. (acquired by Roche), Ziarco Pharma Ltd. (acquired by Novartis AG), and ZS Pharma, Inc. (acquired by AstraZeneca plc). Prior to Sofinnova, Dr. Freedland was a Principal at Novo A/S. Before his transition to healthcare investing, Dr. Freedland was a Vice President in the healthcare investment banking practice at Morgan Stanley. Prior to transitioning to life sciences finance, Dr. Freedland worked as a research scientist for Roche focusing on preclinical drug discovery and novel target identification for psychiatric and neurodegenerative diseases. Dr. Freedland served on the board of directors of Jiya Acquisition Corp. from November 2020 to November 2022. Dr. Freedland has also served on the board of directors of multiple private companies. Dr. Freedland received his Ph.D. in Pharmacology from Wake Forest University School of Medicine, his M.B.A. from the Kellogg School of Management and his B.A. in Psychology and Religious Studies from Connecticut College.

We believe Dr. Freedland is qualified to serve on our Board because of his extensive leadership, investment and business development experience in the life sciences sector, as well as his experience as a director of several biotechnology company boards.

Rachel McMinn, Ph.D. Dr. McMinn has served as Chief Executive Officer and Executive Chair of our Board since December 2023. Dr. McMinn founded Private Neurogene in January 2018 and served as its Chief Executive Officer and a

member of its board of directors until December 2023. Prior to founding Neurogene, she served as Chief Business and Strategy Officer of Intercept Pharmaceuticals, Inc. (formerly Nasdaq: ICPT, until its acquisition by Alfasigma S.p.A.), a biopharmaceutical company dedicated to the treatment of patients with serious liver disease, from April 2014 to December 2017. Prior to her operational experience, Dr. McMinn was an award-winning biotechnology analyst, with 13 years of experience at firms such as Bank of America Merrill Lynch, Cowen and Company and Piper Jaffray. Dr. McMinn has served on the board of directors of Neurogene since January 2018. Dr. McMinn also serves on the board of directors of Everyone Medicines since 2021, and prior to that the non-profit Everyone Foundation from 2019 to 2021. Dr. McMinn received her B.A., magna cum laude, from Cornell University and her Ph.D. from The Scripps Research Institute, and was awarded a Post-Doctoral Miller Fellowship at the University of California, Berkeley.

We believe Dr. McMinn is qualified to serve on our Board because of her in-depth knowledge of the Company, her operational and senior management experience, and her extensive healthcare investment research in the biotechnology industry.

Class II Continuing in Office

Sarah B. Noonberg, M.D., Ph.D. Dr. Noonberg has served as a member of our Board since August 2019. Dr. Noonberg has over 20 years of industry experience leading development programs from discovery to commercialization across a range of indications, and has served as the Chief Medical Officer of Metagenomi, Inc. (Nasdaq: MGX), a next generation gene editing biotechnology company, since January 2023. Prior to Metagenomi, from September 2020 to September 2022, Dr. Noonberg served as the Chief Medical Officer of Maze Therapeutics, a human-genetics driven research and development company, and from May 2018 to May 2019, she served as the Chief Medical Officer of Nohla Therapeutics Inc., a developer of universal, off-the-shelf cell therapies for patients with hematological malignancies and other critical diseases. Prior to Nohla Therapeutics, Dr. Noonberg served as the Chief Medical Officer of Prothena Corporation plc (Nasdaq: PRTA), a biotechnology company, from May 2017 to May 2018. Dr. Noonberg previously served as Group Vice President and Head of Global Clinical Development at BioMarin Pharmaceuticals Inc. (Nasdaq: BMRN), a biotechnology company, from August 2015 to March 2017. From May 2007 to August 2015, she held several positions at Medivation, Inc., a biopharmaceutical company, including as Senior Vice President of Early Development. Dr. Noonberg has served as a member of the board of directors of Marinus Pharmaceuticals, Inc. (Nasdaq: MRNS), a biopharmaceutical company, since May 2023 and she previously served on the board of directors of Protagonist Therapeutics, Inc (Nasdaq: PTGX), a biopharmaceutical company, from December 2017 to May 2023. Dr. Noonberg received her M.D. from the University of California, San Francisco, her Ph.D. in Bioengineering from the University of California, Berkeley, and her B.S. in Engineering from Dartmouth College. She is a board-certified internist and completed her residency at Johns Hopkins Hospital.

We believe Dr. Noonberg is qualified to serve on our Board because of her senior leadership and public company board experience in the biopharmaceutical industry as well as her extensive medical knowledge and clinical development and regulatory experience.

Keith Woods. Mr. Woods has served as a member of our Board since December 2023. Mr. Woods is an advisor to the board of directors of argenx SE (Nasdaq: ARGX), a biopharmaceutical company, where he served as Chief Operating Officer from April 2018 to March 2023. Mr. Woods has over 30 years of experience in the biopharmaceutical industry. Prior to argenx, Mr. Woods served as Senior Vice President of North American Operations for Alexion Pharmaceuticals, Inc., a biopharmaceutical company, where he managed a team of several hundred people in the U.S. and Canada and was responsible for more than $1 billion in annual sales. Within Alexion, Mr. Woods had previously served as Vice President and Managing Director of Alexion UK, overseeing all aspects of Alexion’s UK business, and Vice President of U.S. Operations and Executive Director of Sales, leading the launch of Soliris in atypical hemolytic uremic syndrome. Prior to Alexion, Mr. Woods held various positions of increasing responsibility within Roche, Amgen Inc. and Eisai Co., Ltd., over a span of 20 years. Mr. Woods has served on the board of directors of X4 Pharmaceuticals, Inc. (Nasdaq: XFOR) since October 2023, Rocket Pharmaceuticals, Inc. (Nasdaq: RCKT) since December 2023, and TScan Therapeutics, Inc. (Nasdaq: TCRX) since December 2023. Mr. Woods received his B.S. in Marketing from Florida State University.

We believe Mr. Woods is qualified to serve on our Board because of his extensive senior management, leadership and operational experience in the biopharmaceutical industry.

Class III Directors Continuing in Office

Robert Baffi, Ph.D. Dr. Baffi has served as a member of our Board since December 2023 and served as a member of the board of directors of Private Neurogene from September 2020 to December 2023. Dr. Baffi is a Venture Partner at Samsara, an investment company focused on the life sciences industry, which he joined in March 2021. Dr. Baffi had a 23-year tenure at BioMarin Pharmaceutical Inc. (Nasdaq: BMRN), a global biotechnology company, from May 2000 to March 2023, where he served as President of Global Manufacturing & Technical Operations from 2018 to 2020, was responsible for overseeing manufacturing, process development based on the baculovirus system, quality, logistics, engineering and analytical chemistry, and led the building of one of the first gene therapy manufacturing facilities of its kind, before he became Senior Advisor to the Chairman and Chief Executive Officer in 2021. Prior to BioMarin, Dr. Baffi served 14 years in a number of

increasingly senior positions at Genentech, Inc., primarily in the functional area of quality control. Prior to Genentech, Dr. Baffi worked at Cooper BioMedical, Inc. as a Research Scientist and at the Becton Dickinson Research Center as a Post-Doctoral Fellow. Dr. Baffi has contributed to the approval and commercial success of 28 products. Dr. Baffi has served as a member of the board of directors of Mosaic ImmunoEngineering Inc. (OTCMTKS: CPMV), a biotechnology company, since June 2021 and Bionic Sight, Inc., a biotechnology company, since 2020. Dr. Baffi also serves on the science advisory board of the National Institute for Bioprocessing Research & Training. Dr. Baffi received his Ph.D., M. Phil. and B.S. in biochemistry from the City University of New York and his M.B.A. from Regis University.

We believe Dr. Baffi is qualified to serve on our Board because of his extensive education and investment, management, commercialization, operational and leadership experience in the life sciences sector.

Rohan Palekar. Rohan Palekar has served as a member of our Board since March 2022. Mr. Palekar has served as Chief Executive Officer and a member of the board of directors of 89bio, Inc. (Nasdaq: ETNB), a biopharmaceutical company, since June 2018. Prior to 89bio, Mr. Palekar held various positions at Avanir Pharmaceuticals, Inc., a specialty pharmaceutical company, including the role of President and Chief Executive Officer of Avanir from December 2015 to July 2017, where he led the company following its acquisition by Otsuka Pharmaceutical Co., Ltd. in 2015. Prior to the acquisition, Mr. Palekar served as Executive Vice President and Chief Operating Officer in 2015 and as Senior Vice President and Chief Commercial Officer of Avanir from March 2012 to March 2015. Prior to Avanir, from 2008 to 2011, Mr. Palekar served as Chief Commercial Officer for Medivation, Inc., a biopharmaceutical company, where he was responsible for all commercial activities, chemistry, manufacturing and controls, medical affairs, and public relations functions. Mr. Palekar also spent over 16 years at Johnson & Johnson (NYSE: JNJ), a diversified healthcare company, in various senior commercial and strategic management roles. Mr. Palekar served as a trustee for Aim High for High School, a non-profit educational institution, from 2018 till 2023 and chair of the board of trustees from 2021 to 2023. Mr. Palekar earned his M.B.A. from the Tuck School of Business at Dartmouth College, his B.Com. in Accounting from the University of Mumbai and his L.L.B. from the University of Mumbai. Mr. Palekar is also a certified Chartered Accountant and a Cost and Management Accountant.

We believe Mr. Palekar is qualified to serve on the board of directors of the combined company because of his operational experience in the biopharmaceutical industry as well as his senior management and leadership experience.

Board Recommendation

The Board recommends a vote “FOR” the election of each of the Class I director nominees set forth above.

| | | | | | | | | | | |

| NEOLEUKIN THERAPEUTICS, INC.

188 East Blaine Street, Suite 450

Seattle, WA 98102 | | |

PROPOSAL 2: NON-BINDING ADVISORY VOTE ON EXECUTIVE COMPENSATIONIn accordance with the rules of the SEC and pursuant to the Dodd-Frank Act, we are providing stockholders with an opportunity to make a non-binding, advisory vote on the compensation of our named executive officers. This non-binding advisory vote is commonly referred to as a “say-on-pay” vote.

The say-on-pay vote is a non-binding, advisory vote on the compensation of our “named executive officers,” as described in this Proxy Statement in the “Executive Compensation” section, the tabular disclosure regarding such compensation and the accompanying narrative disclosure. The say-on-pay vote is not a vote on our general compensation policies or on the compensation of our Board. Stockholders are urged to read the “Executive Compensation” section of the Proxy Statement, which discusses how our executive compensation policies and procedures implement our compensation philosophy. Our Compensation Committee and Board believe that these policies and procedures are effective in implementing our compensation philosophy and in achieving our goals.

As an advisory vote, this proposal is not binding. However, our Board and Compensation Committee, which is responsible for designing and administering our executive compensation program, value the opinions expressed by stockholders in their vote on this proposal and will consider the outcome of the vote when making future compensation decisions for our named executive officers.

We are required to hold a say-on-pay vote at least once every three years, and we have determined that holding a say-on-pay vote every year is appropriate for the 2023

Annual MeetingCompany at this time. Unless the Board modifies its policy on the frequency of Stockholdersholding say-on-pay advisory votes, the next say-on-pay vote is expected to occur in 2025.

TO BE HELD ON JUNE 8, 2023Board Recommendation

Questions and Answers about these Proxy Materials and VotingThe Board recommends a vote “FOR” this proposal.

| | | | | | | | | | | | | | | | | |

| | | | Pursuant to rules adopted by the Securities and Exchange Commission (the “SEC”), we have elected to provide access to our proxy materials over the internet. Accordingly, we have sent you a Notice of Internet Availability of Proxy Materials (the “Notice”) because the Board of Directors (the “Board”) of Neoleukin Therapeutics, Inc. (the “Company,” “Neoleukin,” “we,” “us”, or “our”) is soliciting your proxy to vote at the 2023 Annual Meeting of Stockholders (the “Annual Meeting”), including at any adjournments or postponements of the meeting. All stockholders will have the ability to access the proxy materials on the website referred to in the Notice or request to receive a printed set of the proxy materials. Instructions on how to access the proxy materials over the internet or to request a printed copy may be found in the Notice.

We intend to mail the Notice on or about April 27, 2023, to all stockholders of record entitled to vote at the Annual Meeting.

| |

| Why did I receive a notice regarding the availability of proxy materials on the internet? | | | |

| | | | |

| | | | |

| | | | | | | | | | | | | | |

| | Neoleukin Therapeutics, Inc. | | 2023 Proxy Statement | 1 |

PROPOSAL 3: RATIFICATION OF INDEPENDENT AUDITOR APPOINTMENT | | | | | | | | | | | | | | | | | |

| | | | In order to facilitate stockholder participation and save on expenses associated with conducting an in-person annual meeting, this year’s annual meeting will be accessible online through the Internet. We have worked to offer the same participation opportunities as if you attended the annual meeting in person and hope the online format will allow more stockholders to participate by removing any barriers caused by travel requirements. You may attend the annual meeting online, including voting and submitting questions, at www.virtualshareholdermeeting.com/NLTX2023. We encourage you to access the annual meeting before it begins. Online check-in will begin at 1:15 p.m. Pacific Time on the date of the annual meeting. If you have difficulty accessing the meeting, please call TFN: 844-986-0822 / International: 303-562-9302. We will have technicians available to assist you.

Please note that if you have more than one account through which you hold shares, you will receive more than one control number. The control number is used to vote your shares, and is also used to log on to the meeting website to virtually attend the meeting, which will allow you to vote the shares held in the account associated with that control number at the meeting. However, you will not be able to vote shares held in other accounts not associated with the control number you are using to log in to the virtual shareholder meeting. Therefore, it is important that you return your proxy cards for all of your accounts prior to the Annual Meeting so that all of your shares may be counted.

| |

| How do I attend

this year’s Annual Meeting? | | | |

| | | | |

| | | | |

Our Audit Committee has appointed Deloitte & Touche LLP (“Deloitte”) as the Company’s independent registered public accounting firm for the year ending December 31, 2024. In this Proposal 3, we are asking stockholders to vote to ratify this appointment. Representatives of Deloitte are expected to be present at the Annual Meeting. They will have the opportunity to make a statement, if they desire to do so, and are expected to be available to respond to appropriate questions from stockholders. | | | | | | | | | | | | | | | | | |

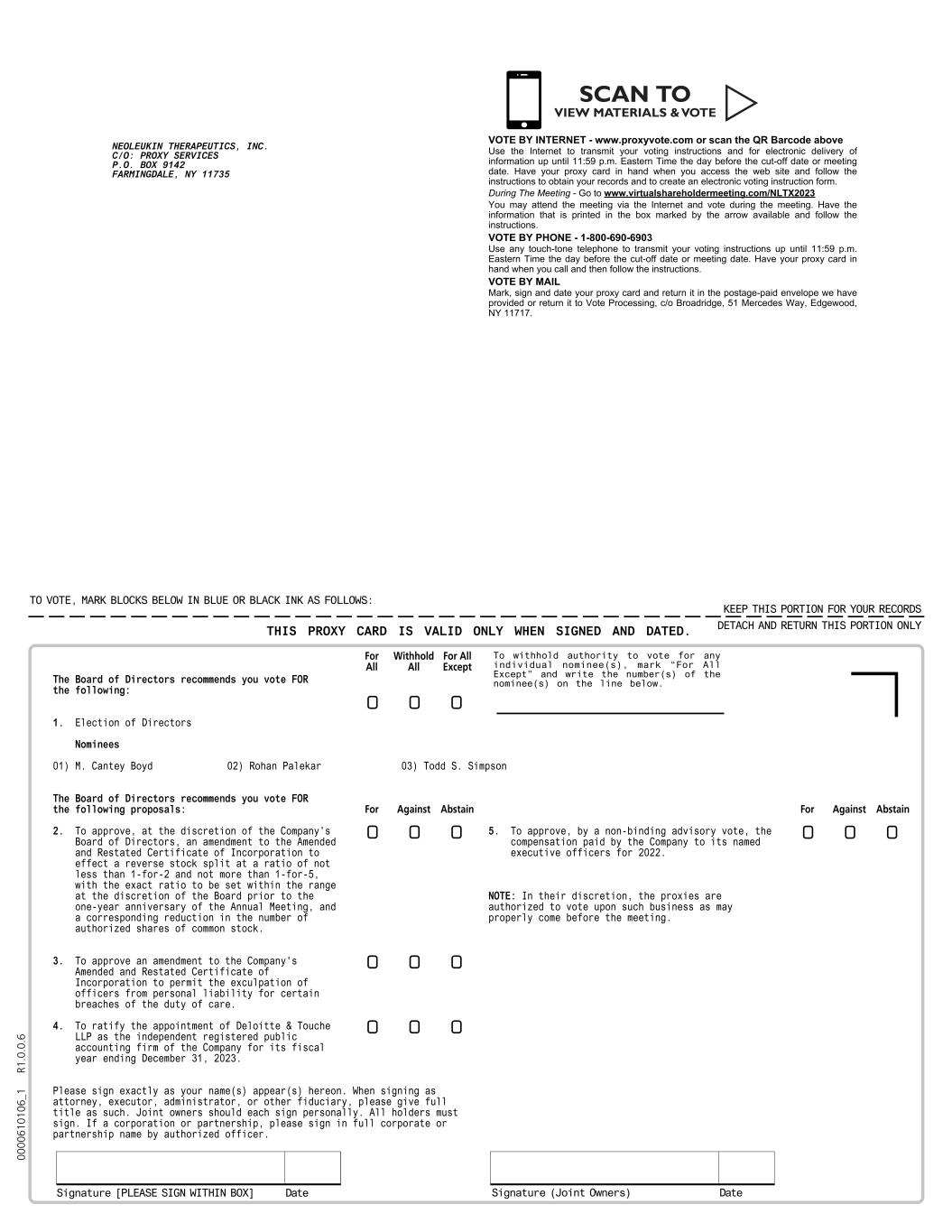

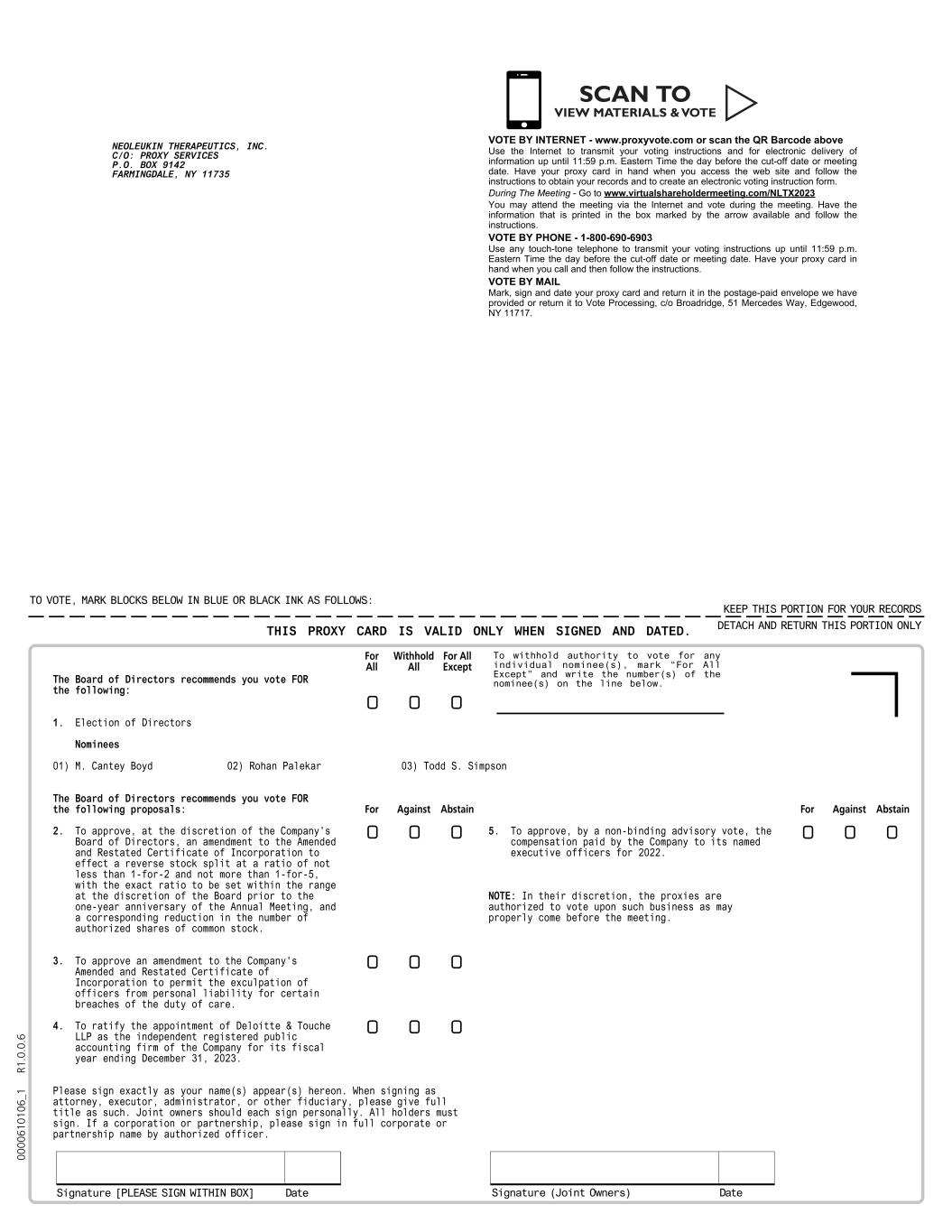

| | | | At the Annual Meeting, stockholders will act upon the matters outlined in the Notice of Annual Meeting of Stockholders, including:

• To elect M. Cantey Boyd, Rohan Palekar, and Todd S. Simpson as Class III directors of the Company to hold office until the 2026 Annual Meeting of Stockholders.

• To approve an amendment to our Amended and Restated Certificate of Incorporation (our “Certificate of Incorporation”) to implement a reverse stock split, at the discretion of our Board, of not less than 1-for-2 shares and not more than 1-for-5 shares.

• To approve the amendment to our Certificate of Incorporation to permit exculpation of officers from personal liability for certain breaches of the duty of care.

• To ratify the appointment of Deloitte & Touche LLP as the independent registered public accounting firm of the Company for its fiscal year ending December 31, 2023.

• To approve, by a non-binding advisory vote, the compensation paid by the Company to its named executive officers in 2022.

• To conduct any other business properly brought before the meeting.

| |

| What am

I voting on? | | | |

| | | | |

| | | | |

Stockholder ratification of the appointment of Deloitte as the Company’s independent auditor is not required by law or our Bylaws. However, we are seeking stockholder ratification as a matter of good corporate practice. If our stockholders fail to ratify the appointment, the committee will reconsider its appointment. Even if the appointment is ratified, the committee, in its discretion, may direct the appointment of a different independent auditor at any time during the year if it determines that such a change would be in the best interests of the Company and our stockholders.Deloitte has served as the independent auditor since 2023. The following table summarizes the audit fees billed and expected to be billed by Deloitte for the indicated fiscal years and the fees billed by Deloitte for all other services rendered during the indicated fiscal years. All services associated with such fees and provided after the Merger Closing were pre-approved by our Audit Committee in accordance with the “Pre-Approval Policies and Procedures” described below.

| | | | | | | | | | | |

| Year Ended

December 31, |

| Fee Category | 2023 | | 2022 |

| Audit Fees(1) | $ | 482,000 | | | $ | — |

| Audit-Related Fees(2) | — | | | — |

| Tax Fees(3) | — | | | — |

| All Other Fees(4) | — | | | — |

| Total Fees | $ | 482,000 | | | $ | — | |

Prior to the Merger Closing, Ernst & Young LLP (“Ernst &Young”) served as the independent auditor of Private Neurogene.

The following table summarizes the audit fees billed and expected to be billed by Ernst & Young for services rendered for the years ended December 31, 2023 and 2022 in connection with the audit of the financial statements of Private Neurogene for the year ended December 31, 2022:

| | | | | | | | | | | |

| Year Ended

December 31, |

| Fee Category | 2023 | | 2022 |

| Audit Fees(1) | $ | 761,620 | | | $ | 261,235 | |

| Audit-Related Fees(2) | — | | | — | |

| Tax Fees(3) | — | | | — | |

| All Other Fees(4) | — | | | — | |

| Total Fees | $ | 761,620 | | | $ | 261,235 | |

(1) Consists of fees for professional services rendered for the audit of our financial statements, review of our interim condensed financial statements, professional consultations with respect to accounting matters and assistance with registration statements filed with the SEC and services that are normally provided by Deloitte or Ernst & Young, as applicable in connection with statutory and regulatory filings or engagements.

During the fiscal year 2023, Deloitte performed audit services for Neoleukin Therapeutics, Inc., merger acquirer of Neurogene Inc. Audit fees related to the services provided to Neoleukin Therapeutics, Inc. totaled $463,233 and consisted of services performed in connection with Forms 10-Q, Form S-4 and 8-K filings for fiscal year 2023.

(2) Consists of fees for assurance and related services reasonably related to the performance of the audit or review of our financial statements.

(3) Consists of fees for professional services for tax compliance, tax advice and tax planning.

(4) Consists of fees for all other services.

| | | | | | | | | | | | | | | | | |

X | 2 | 2023 Proxy Statement | | Neoleukin Therapeutics, Inc. | | |

Pre-Approval Policies and Procedures | | | | | | | | | | | | | | | | | |

| | | | Our Board has set April 20, 2023 as the record date for the Annual Meeting. If you were a stockholder of record of our common stock at the close of business on April 20, 2023, you are entitled to vote atOur Audit Committee has adopted procedures requiring the pre-approval of all audit and non-audit services performed by our independent auditor in order to assure that these services do not impair the auditor’s independence. These procedures generally approve the performance of specific services subject to a cost limit for all such services. This general approval is reviewed, and if necessary modified, at least annually. Management must obtain the specific prior approval of the committee for each engagement of our auditor to perform other audit-related or non-audit services. The committee does not delegate its responsibility to pre-approve services performed by our auditor to any member of management. The committee has delegated authority to the committee chair to pre-approve audit and non-audit services to be provided to us by our auditor provided that the fees for such services do not exceed $100,000. Any pre-approval of services by the committee chair pursuant to this delegated authority must be reported to the committee at its next regularly scheduled meeting. As of the record date, 42,828,346 shares of our common stock were issued and outstanding and, therefore, eligible to vote at the meeting.

Holders of common stock are entitled to one vote per share. There is no cumulative voting.

| |

| Who is entitled to

vote at the meeting? | | | |

| | | | |

| | | | |

| | | | | | | | | | | | | | | | | |

| | | | The Board knows of no other matters that will be presented for consideration at the Annual Meeting. If any other matters are properly brought before the meeting, it is the intention of the persons named in the accompanying proxy to vote on those matters in accordance with their best judgment. | |

| What if another matter is properly brought before

the meeting? | | | |

| | | | |

Report of the Audit Committee | | | | | | | | | | | | | | |

| | Neoleukin Therapeutics, Inc. | | 2023 Proxy Statement | 3 |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | You may either vote “For” or “Withhold” for each nominee to the Board of Directors. On proposals for the approval of the Reverse Stock Split Proposal, the Exculpation Amendment, the ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm, and the advisory approval of the compensation of named executive officers, you may vote “For” or “Against” or abstain from voting.

The procedures for voting are as follows: | |

| How do I vote? | | | |

| | | | |

| | | | |

| | | | During Meeting

| By Mail

| By Phone

| By Internet

| |

| | | | | | | | |

| | | | Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may vote online at the Annual Meeting, vote by proxy over the telephone, vote by proxy through the internet or vote by proxy using a proxy card that you may request or that we may elect to deliver at a later time. Whether or not you plan to attend the Annual Meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the Annual Meeting and vote in person even if you have already voted by proxy.

•To vote online at the meeting, attend the Annual Meeting on the internet at www.virtualshareholdermeeting.com/NLTX2023. If you hold shares in multiple accounts, please note that you will only be able to vote shares associated with the control number you use to log in to the meeting.

•To vote using the proxy card, simply complete, sign and date the proxy card that may be delivered and return it promptly in the envelope provided. If you return your signed proxy card to us before the Annual Meeting, we will vote your shares as you direct.

•To vote over the telephone, dial toll-free 1-800-690-6903 using a touch-tone phone and follow the recorded instructions. You will be asked to provide the company number and control number from the Notice. Your telephone vote must be received by 11:59 p.m., Eastern Time, on June 7, 2023 to be counted.

•To vote through the internet, go to www.proxyvote.com to complete an electronic proxy card. You will be asked to provide the company number and control number from the Notice. Your internet vote must be received by 11:59 p.m., Eastern Time, on June 7, 2023 to be counted.

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If you are a beneficial owner of shares registered in the name of your broker, bank or other agent, you should have received a Notice containing voting instructions from that organization rather than from us. Simply follow the voting instructions in the Notice to ensure that your vote is counted. To vote online at the Annual Meeting, you must obtain a valid proxy from your broker, bank or other agent. Follow the instructions from your

| |

| | | | | | | | | | | | | | | | | |

X | 4 | 2023 Proxy Statement | | Neoleukin Therapeutics, Inc. | | |

| | | | | | | | | | | | | | | | | |

| | | | broker or bank included with these proxy materials or contact your broker or bank to request a proxy form. Internet proxy voting will be provided to allow you to vote your shares online, with procedures designed to ensure the authenticity and correctness of your proxy vote instructions. However, please be aware that you must bear any costs associated with your internet access, such as usage charges from internet access providers and telephone companies.

We strongly recommend that you vote your shares in advance of the meeting as instructed above, even if you plan to attend the meeting.

On each matter to be voted upon, you have one vote for each share of common stock you own as of April 20, 2023.

| |

| | | | |

| | | | |

| | | | |

| | | | | | | | | | | | | | | | | |

| | | | Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record and do not vote by completing your proxy card, by telephone, through the internet or online at the Annual Meeting, your shares will not be voted.

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If you are a beneficial owner and do not instruct your broker, bank, or other agent how to vote your shares, the question of whether your broker or nominee will still be able to vote your shares depends on whether the particular proposal is considered to be a “routine” matter. Brokers and nominees can use their discretion to vote “uninstructed” shares with respect to matters that are considered to be “routine,” but not with respect to “non-routine” matters. Under the rules and interpretations of various national and regional securities exchanges, “non-routine” matters are matters that may substantially affect the rights or privileges of stockholders, such as mergers, stockholder proposals, elections of directors (even if not contested), executive compensation (including any non-binding advisory stockholder votes on executive compensation and on the frequency of stockholder votes on executive compensation), and certain corporate governance proposals, even if management-supported. Ratification of the appointment of auditors is considered a “routine” matter. Accordingly, unless you provide instructions, your broker or nominee may not vote your shares on the election of any of the nominees for director, the Reverse Stock Split Proposal, the Exculpation Amendment, or the non-binding advisory approval of compensation of our named executive officers, but may vote your shares on the ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023. When a beneficial owner of shares held in “street name” does not give instructions to the broker or nominee holding the shares as to how to vote on matters deemed to be “non-routine,” the broker or nominee cannot vote the shares. These unvoted shares are counted as “broker non-votes.”

| |

| What happens

if I do not vote? | | | |

| | | | |

| | | | |

| | | | | | | | | | | | | | |

| | Neoleukin Therapeutics, Inc. | | 2023 Proxy Statement | 5 |

| | | | | | | | | | | | | | | | | |

| | | | If you return a signed and dated proxy card or otherwise vote without marking voting selections, your shares will be voted, as applicable, “For” the election of all of the nominees for director, “For” the Reverse Stock Split Amendment, “For” the Exculpation Amendment, “For” the ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2023, and “For” the non-binding advisory approval of compensation of our named executive officers. If any other matter is properly presented at the meeting, your proxyholder (one of the individuals named on your proxy card) will vote your shares using his or her best judgment. | |

| What if I return

a proxy card or otherwise vote, but do not make specific choices? | | | |

| | | | |

| | | | |

| | | | | | | | | | | | | | | | | |

| | | | We will pay for the entire cost of soliciting proxies. In addition to these proxy materials, our directors and employees may also solicit proxies in person, by telephone, or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. We may also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners. | |

| Who is paying

for this proxy solicitation? | | | |

| | | | |

| | | | | | | | | | | | | | | | | |

| | | | If you receive more than one Notice, your shares may be registered in more than one name or in different accounts. Please follow the voting instructions on the Notices to ensure that all of your shares are voted.

Please note that if you hold shares in more than one account, you will receive a different control number for each account. You may log in to the Annual Meeting using any of your control numbers, however, you will only be able to vote the shares associated with that control number at the Annual Meeting. Therefore we encourage you to submit your votes in advance of the meeting for all accounts you hold to ensure your vote is counted at the meeting. | |

| What does it mean

if I receive more than one Notice? | | | |

| | | | | |

| | | | | | | | | | | | | | | | | |

X | 6 | 2023 Proxy Statement | | Neoleukin Therapeutics, Inc. | | |

| | | | | | | | | | | | | | | | | |

| | | | Stockholder of Record: Shares Registered in Your Name

Yes. You can revoke your proxy at any time before the final vote at the meeting. If you are the record holder of your shares, you may revoke your proxy in any one of the following ways:

•You may submit another properly completed proxy card with a later date.

•You may grant a subsequent proxy by telephone or through the internet.

•You may send a timely written notice that you are revoking your proxy to our Corporate Secretary at 188 East Blaine Street, Suite 450, Seattle, Washington 98102.

•You may attend the Annual Meeting and vote online. Simply attending the meeting will not, by itself, revoke your proxy.

Your most current proxy card or telephone or internet proxy is the one that is counted.

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If your shares are held by your broker or bank as a nominee or agent, you should follow the instructions provided by your broker or bank.

| |

| Can I change my

vote after submitting my proxy? | | | |

| | | | |

| | | | |

| | | | | | | | | | | | | | | | | |

| | | | To be considered for inclusion in next year’s proxy materials, your proposal must be submitted in writing by December 29, 2023, to our Corporate Secretary at 188 East Blaine Street, Suite 450, Seattle, Washington 98102, and must comply with all applicable requirements of Rule 14a-8 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”); provided, however, that if our 2024 Annual Meeting of Stockholders is held before May 9, 2024 or after July 8, 2024, then the deadline is a reasonable amount of time prior to the date we begin to print and mail our proxy statement for the 2024 Annual Meeting of Stockholders. If you wish to submit a proposal (including a director nomination) at the 2024 Annual Meeting of Stockholders that is not to be included in next year’s proxy materials, the proposal must be received by our Corporate Secretary not later than the close of business on March 25, 2024 nor earlier than the close of business on February 24, 2024; provided, however, that if our 2024 Annual Meeting of Stockholders is held before May 9, 2024 or after August 7, 2024, then the proposal must be received no earlier than the close of business on the 105th day prior to such meeting and not later than the close of business on the later of the 90th day prior to such meeting or the 10th day following the day on which public announcement of the date of such meeting is first made. You are also advised to review our bylaws, which contain additional requirements about advance notice of stockholder proposals and director nominations. | |

| When are stockholder proposals and director nominations

due for next year’s annual meeting? | | | |

| | | | |

| | | | |

| | | | | | | | | | | | | | |

| | Neoleukin Therapeutics, Inc. | | 2023 Proxy Statement | 7 |

| | | | | | | | | | | | | | | | | |

| | | | Votes will be counted by the inspector of election appointed for the meeting, who will separately count, for the proposal to elect directors, votes “For,” “Withhold” and broker non-votes; and, with respect to the Reverse Stock Split Amendment, Exculpation Amendment, ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm and approval on a non-binding, advisory basis of the compensation for our named executive officers, votes “For,” “Against,” abstentions and broker non-votes. | |

| How are

votes counted? | | | |

| | | | |

| | | | |

| | | | | | | | | | | | | | | | | |

| | | | For the election of directors, the three nominees to serve until the 2026 Annual Meeting of Stockholders receiving the most “For” votes from the shares present online at the meeting or represented by proxy and entitled to vote generally on the election of directors will be elected. Because directors are elected by a plurality of the votes received, only votes “For” will affect the outcome. A “Withhold” will have the same effect as an abstention. Broker non-votes will have no effect.

To be approved, Proposal No. 2, the approval of the Reverse Stock Split Amendment, must receive “For” votes from the holders of a majority of the voting power of all of the outstanding shares of common stock. Abstentions and broker non-votes will have the same effect as an “Against” vote on that proposal.

To be approved, Proposal No. 3, the approval of the Exculpation Amendment, must receive “For” votes from the holders of at least sixty-six and two-thirds percent of the voting power of all of the outstanding shares of common stock. Abstentions and broker non-votes will have the same effect as an “Against” vote on that proposal.

To be approved, Proposal No. 4, ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the year ending December 31, 2023 must receive “For” votes from the holders of a majority of shares present online at the meeting or represented by proxy and are voted “For” or “Against” the matter. If you “Abstain” from voting, it will have no effect on the vote. Broker non-votes will have no effect.

Proposal No. 4 is considered a routine matter and therefore no broker non-votes are expected to exist in connection with Proposal No. 4. The other proposals are considered non-routine matters.

To be approved, Proposal No. 5, a non-binding advisory vote on the compensation for our named executive officers, must receive “For” votes from the holders of a majority of shares present in person or represented by proxy and are voted for or against the matter. If you “Abstain” from voting, it will have no effect on the vote. Broker non-votes will have no effect.

| |

| How many votes are needed to approve each proposal? | | | |

| | | | |

| | | | |

| | | | | | | | | | | | | | | | | |

X | 8 | 2023 Proxy Statement | | Neoleukin Therapeutics, Inc. | | |

| | | | | | | | | | | | | | | | | |

| | | | A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if stockholders holding at least a majority of the outstanding shares entitled to vote are present online at the meeting or represented by proxy. On the record date, there were 42,828,346 shares outstanding and entitled to vote. Thus, the holders of 21,414,174 shares must be present online at the meeting or represented by proxy at the Annual Meeting to have a quorum.

Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you vote online at the meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, the holders of a majority of shares present online at the meeting or represented by proxy may adjourn the Annual Meeting to another date.

| |

| What is the quorum requirement? | | | |

| | | | |

| | | | |

| | | | | | | | | | | | | | | | | |

| | | | You will vote on the following management proposals:

1.To elect each of M. Cantey Boyd, Rohan Palekar, and Todd S. Simpson as Class III directors of the Company to hold office until the 2026 Annual Meeting of Stockholders.

2.To approve the Reverse Stock Split Amendment.

3.To approve the Exculpation Amendment.

4.To ratify the appointment of Deloitte & Touche LLP as the independent registered public accounting firm of the Company for its fiscal year ending December 31, 2023.

5.To approve, by a non-binding advisory vote, the compensation paid by the Company to its named executive officers in 2022.

The Board recommends that you vote FOR all the nominees in Proposal No. 1, and FOR Proposal Nos. 2, 3, 4 and 5.

| |

| How does the Board recommend that I vote? | | | |

| | | | |

| | | | |

| | | | | | | | | | | | | | | | | |

| | | | Preliminary voting results will be announced at the Annual Meeting. In addition, final voting results will be published in a current report on Form 8-K that we expect to file within four business days after the Annual Meeting. If final voting results are not available to us in time to file a Form 8-K within four business days after the meeting, we intend to file a Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file an amended Form 8-K to publish the final results. | |

| How can I find out

the results of the voting at the Annual Meeting? | | | |

| | | | |

| | | | | | | | | | | | | | |

| | Neoleukin Therapeutics, Inc. | | 2023 Proxy Statement | 9 |

| | | | | | | | | | | | | | | | | |

| | | | By submitting your proxy card, you authorize the proxies named therein to use their judgment to determine how to vote on any other matter brought before the meeting. We do not know of any other business to be considered at the meeting.

The proxies’ authority to vote according to their judgment applies only to shares you own as the stockholder of record. | |

| How will the proxies vote on any other business brought

up at the meeting? | | | |

| | | | |

| | | | | | | | | | | | | | | | | |

| | | | Stockholders may communicate with our Board by sending a letter addressed to the Board of Directors, all independent directors or specified individual directors to: Neoleukin Therapeutics, Inc., c/o Corporate Secretary at 188 East Blaine Street, Suite 450, Seattle, Washington 98102. All communications will be compiled by the Secretary and submitted to the Board or the specified directors on a periodic basis. | |

| How can I communicate with Neoleukin’s Board

of Directors? | | | |

| | | | |